Executive Summary

Glass bottles represent a premium packaging solution in the cosmetics industry, combining functionality, aesthetics, and sustainability. This guide provides B2B buyers and procurement specialists with a detailed analysis of cosmetic glass bottles, covering material science, product classifications, manufacturing processes, and key procurement considerations to inform strategic sourcing decisions.

1. Material Science and Formation of Cosmetic Glass

1.1 Chemical Composition and Structure

Glass is an inorganic, non-metallic material manufactured through the high-temperature fusion of raw materials into a viscous liquid that solidifies without crystallization. This amorphous structure gives glass its unique combination of transparency, rigidity, and chemical stability.

Primary Raw Materials:

- Silica (SiO₂): 70-75% – Provides structural backbone

- Soda Ash (Na₂CO₃): 12-16% – Lowers melting temperature

- Limestone (CaCO₃): 10-15% – Enhances chemical durability

- Additional Compounds: Magnesium, aluminum, and boron oxides for specific properties

Common Chemical Formulations:

- Sodium silicate (Na₂SiO₃)

- Calcium silicate (CaSiO₃)

- Sodium-calcium silicate (Na₂O·CaO·6SiO₂)

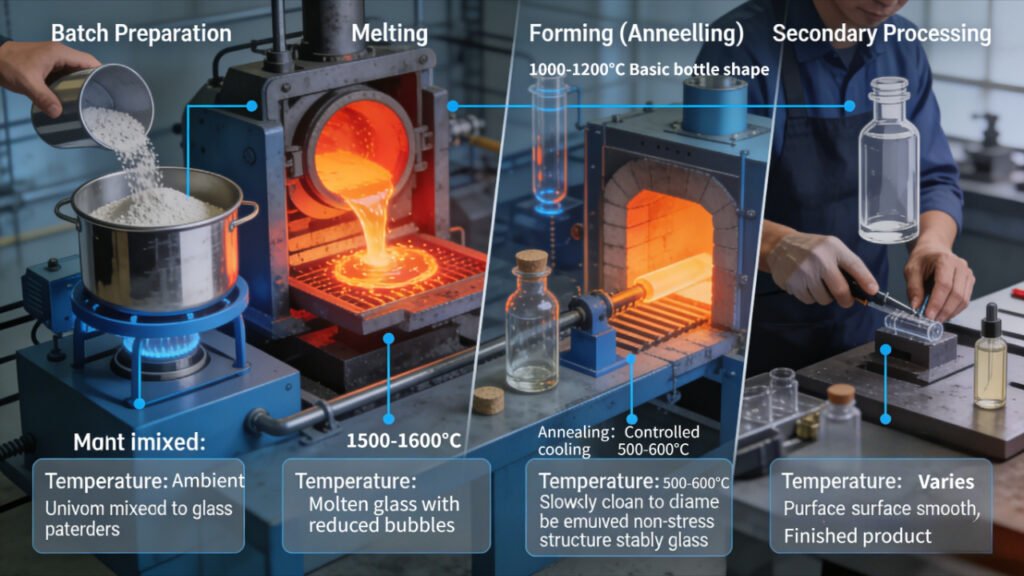

1.2 Manufacturing Process Overview

| Process Stage | Key Activities | Temperature Range | Output Characteristics |

|---|---|---|---|

| Batch Preparation | Raw material weighing and mixing | Ambient | Homogeneous batch mixture |

| Melting | Fusion in furnaces | 1500-1600°C | Molten glass with reduced bubbles |

| Forming | Blowing, pressing, or drawing | 1000-1200°C | Basic bottle shape |

| Annealing | Controlled cooling | 500-600°C | Stress relief, increased durability |

| Secondary Processing | Cutting, polishing, coating | Varies | Finished product |

2. Strategic Advantages for Cosmetic Applications

2.1 Product Integrity and Safety

Barrier Properties: Glass provides an impermeable barrier against oxygen, moisture, and volatile organic compounds (VOCs), extending product shelf life by 20-40% compared to plastic alternatives.

Chemical Inertness: Non-reactive with cosmetic formulations, preventing:

- Leaching of plasticizers or additives

- Product degradation through chemical interaction

- Alteration of fragrance or active ingredient profiles

Sterilization Compatibility: Withstands autoclaving (up to 121°C) and gamma irradiation, making it ideal for sterile or preservative-free formulations.

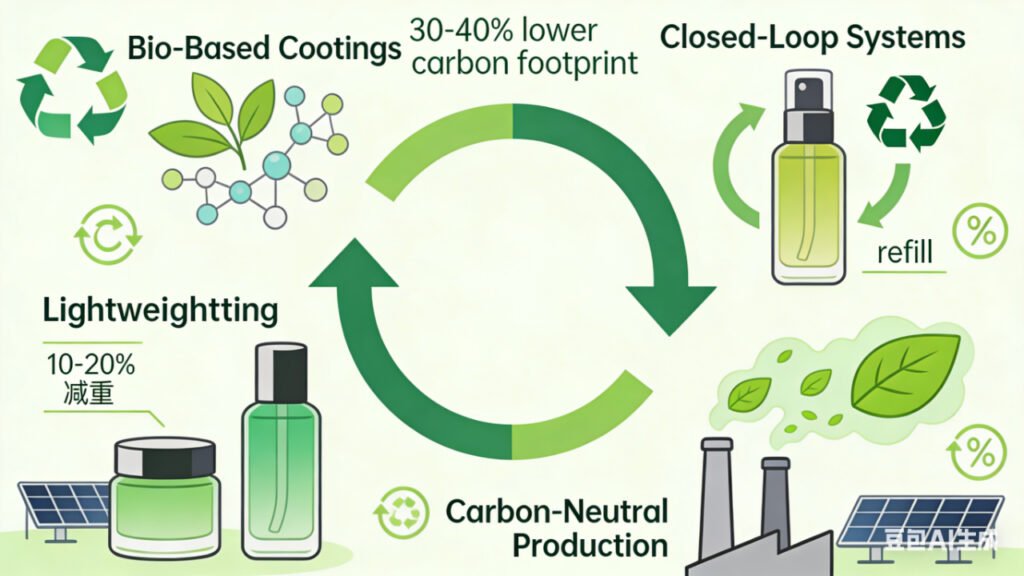

2.2 Sustainability and Circular Economy

Recyclability Metrics:

- Infinite recyclability without quality degradation

- Recycling rate: 80-90% for collected glass

- Energy savings: 20-30% when using cullet (recycled glass) in production

Lifecycle Assessment Benefits:

- Reduced carbon footprint (30-40% lower than PET plastic per unit)

- Compatibility with refill business models

- Alignment with Extended Producer Responsibility (EPR) regulations

2.3 Brand Enhancement and Consumer Perception

Visual Appeal: Transparency showcases product color, viscosity, and purity, enhancing perceived value.

Premium Positioning: Glass packaging correlates with 25-35% higher price positioning in luxury cosmetics segments.

Tactile Experience: Weight and texture communicate quality, with studies indicating 68% of consumers associate heavy glass with premium formulations.

3. Comprehensive Classification System

3.1 By Product Application

| Product Category | Typical Capacity | Closure System | Special Features | Common Glass Types |

|---|---|---|---|---|

| Creams & Balms | 10-50g | Wide mouth with double-layer cap | Easy access for spatulas | Soda-lime glass |

| Serums & Essences | 20-100ml | Airless pump or dropper | Precision dosing, UV protection | Borosilicate, amber glass |

| Toners & Lotions | 40-120ml | Flip-top or screw cap with inner seal | Leak prevention, controlled flow | Soda-lime, flint glass |

| Facial Oils | 5-30ml | Dropper with rubber bulb | Light protection, controlled application | Amber or cobalt blue glass |

| Perfumes & Fragrances | 10ml-30-100ml-200ml | Crimp caps, spray mechanisms | Airtight seals, decorative options | Flint glass, crystal |

3.2 By Manufacturing Technique

Molded Bottles:

- Press-and-Blow: Uniform wall thickness, ideal for wide-mouth containers

- Blow-and-Blow: Better for narrow-neck bottles, higher production speeds

- Narrow Neck Press and Blow (NNPB): Premium finish, precise neck dimensions

Processed/Control Bottles:

- Secondary operations including cutting, grinding, polishing, and decorating

- Tighter dimensional tolerances (±0.5mm vs ±1.0mm for molded)

- Higher perceived quality for luxury segments

3.3 By Design Features

Neck Finish Types:

- Continuous Thread (CT): Standardized threads for universal closures

- Dispensing Closures: Integrated with pump or spray mechanisms

- Cork Finishes: Traditional appearance, requires specific neck dimensions

- Roll-On: Smooth glass beads for applicator systems

Specialty Treatments:

- Frosted/Matte: Acid etching or sandblasting for tactile appeal

- UV Filtering: Incorporation of metal oxides for light protection

- Double-Walled: Insulating properties for temperature-sensitive products

4. Procurement Specifications and Quality Standards

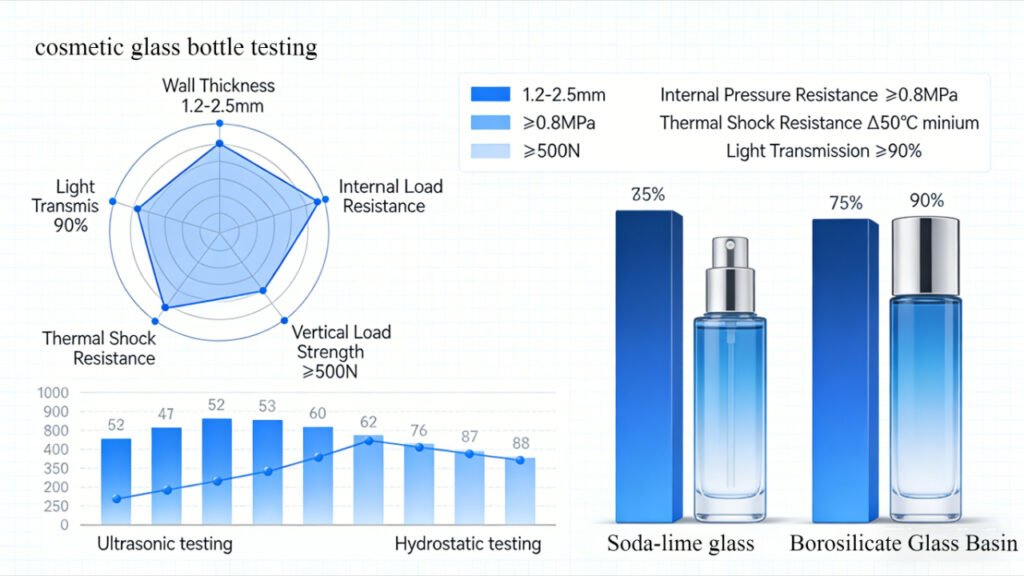

4.1 Technical Specifications Checklist

| Parameter | Standard Range | Testing Method | Importance |

|---|---|---|---|

| Wall Thickness | 1.2-2.5mm | Ultrasonic testing | Strength, weight, cost |

| Internal Pressure Resistance | ≥0.8MPa | Hydrostatic testing | Safety during filling |

| Vertical Load Strength | ≥500N | Compression testing | Stacking stability |

| Thermal Shock Resistance | Δ50°C minimum | Hot-cold cycling | Sterilization compatibility |

| Light Transmission (Clear Glass) | ≥90% | Spectrophotometry | Product visibility |

4.2 Industry Standards and Compliance

- ISO 12775: Normal composition soda-lime glass

- USP <660>: Containers—glass

- EP 3.2.1: Glass containers for pharmaceutical use

- FDA CFR Title 21: Food contact materials regulations

4.3 Minimum Order Quantities and Lead Times

| Bottle Type | Typical MOQ | Standard Lead Time | Rush Production Options |

|---|---|---|---|

| Standard Stock Designs | 1,000 units | 2-3 weeks | 1-2 weeks (+15-25% premium) |

| Custom Molded | 50,000 units | 5-8 weeks | 4-7 weeks (+30-40% premium) |

| Specialty/Decorative | 5,000 units | 2-3 weeks | 1-2 weeks (+20-35% premium) |

5. Decoration and Branding Technologies

5.1 Printing Methods Comparison

| Method | Durability | Color Options | Cost Factor | Best Applications |

|---|---|---|---|---|

| Silk Screening | High (if baked) | Unlimited vividness | $ | Simple logos, regulatory text |

| Heat Transfer | Excellent | Full color, gradients | $$$ | Complex designs, photographic images |

| Digital Printing | Good | Unlimited colors | $$$$ | Small batches, personalized editions |

| Acid Etching | Permanent | Monochromatic | $ | Premium luxury, tactile elements |

| Ceramic Decals | Excellent | Vibrant colors | $$$ | High-end collections, limited editions |

5.2 Specialty Finishes and Effects

- Metallic Coatings: PVD (Physical Vapor Deposition) for mirror or colored metallic effects

- Texture Combinations: Smooth and frosted pattern integration

- Smart Glass: Electrochromic or thermochromic properties for interactive packaging

- Augmented Reality Markers: Integration with digital experiences

6. Logistics and Supply Chain Considerations

6.1 Packaging for Transportation

| Packaging Method | Cost Index | Protection Level | Environmental Impact |

|---|---|---|---|

| Corrugated Partition Boxes | 1.0 | Moderate | High (single-use) |

| PVC/PE Shrink Wrapping | 1.2 | Good | Moderate |

| Returnable Plastic Crates | 1.5 | Excellent | Low (reusable) |

| Molded Pulp Trays | 1.3 | Good | Biodegradable |

6.2 Optimal Containerization

- 20ft Container Capacity: 8,000-12,000 units (depending on size)

- 40ft Container Capacity: 18,000-25,000 units

- Weight Considerations: 30-40% heavier than equivalent plastic packaging

- Insurance Requirements: Higher premium recommended for glass shipments

6.3 Breakage Rate Management

- Industry Standard: 1-2% maximum acceptable during transit

- Prevention Measures: Corner protectors, air cushion systems, stabilized palletizing

- Liability Clauses: Clearly defined in procurement contracts

7. Market Trends and Future Developments

7.1 Sustainability Innovations

- Lightweighting: 10-20% weight reduction through advanced manufacturing

- Closed-Loop Systems: Brand-operated bottle return and refill programs

- Bio-Based Coatings: Plant-derived protective layers replacing traditional materials

- Carbon-Neutral Production: Integration of renewable energy in glass manufacturing

7.2 Smart Packaging Integration

- NFC/RFID Tags: Embedded tracking and authentication

- QR Integration: Direct consumer engagement through bottle graphics

- Fill-Level Indicators: Visual or electronic monitoring systems

- Temperature Sensors: Quality assurance for sensitive formulations

7.3 Customization and Personalization

- Digital Mold Manufacturing: Faster prototype development (2-3 weeks vs 8-10 weeks)

- Modular Design Systems: Interchangeable components for limited editions

- Direct-to-Glass Printing: Small batch customization without minimums

- Hybrid Material Integration: Glass combined with sustainable bioplastics

8. Procurement Decision Framework

8.1 Supplier Evaluation Criteria

- Quality Certifications: ISO 9001, ISO 14001, Sedex/SMETA compliance

- Production Capacity: Monthly output capabilities and scalability

- R&D Investment: Percentage of revenue invested in innovation

- Environmental Performance: Carbon footprint, water usage, recycling rates

- Geographic Location: Proximity to filling facilities and transportation hubs

8.2 Total Cost of Ownership Analysis

Consider beyond unit price:

- Damage rates during filling and distribution

- Compatibility with existing filling lines

- Consumer perception and willingness to pay premium

- End-of-life recycling costs or credits

- Inventory carrying costs due to weight and fragility

8.3 Negotiation Leverage Points

- Volume commitments for price reductions

- Off-season production for better lead times

- Standardization across product lines for mold cost amortization

- Long-term contracts with annual price reviews

- Quality-based incentives/penalties in service agreements

9. Historical Context and Industry Evolution

The use of glass in cosmetics packaging dates to ancient civilizations, but modern applications began with perfume bottles in 17th century Europe. The landmark moment occurred in 1921 when Chanel No. 5 debuted in a rectangular glass bottle, establishing glass as the premium standard for fragrance. The 1950s saw expansion into skincare, driven by technological advances in molding and the growing prestige cosmetics market.

Today, the global cosmetic glass packaging market exceeds $4.2 billion annually, with a projected CAGR of 4.8% through 2028. This growth is fueled by increasing demand for sustainable packaging, premiumization in emerging markets, and innovation in functional glass technologies.

10. Actionable Recommendations for B2B Buyers

- Conduct a packaging audit to identify standardization opportunities across product lines

- Engage suppliers early in product development cycles for optimal design input

- Request sample batches for filling line compatibility testing before large orders

- Implement a dual-supplier strategy for critical bottle designs to mitigate risk

- Invest in relationship development with key glass manufacturers for innovation access

- Consider regional production for high-volume items to reduce logistics costs and carbon footprint

- Evaluate total sustainability impact using lifecycle assessment tools, not just recyclability claims

- Stay informed about material innovations through industry associations like the Glass Packaging Institute

Conclusion: Glass bottles offer cosmetic brands an unparalleled combination of product protection, brand enhancement, and environmental responsibility. For procurement professionals, strategic sourcing requires balancing technical specifications, supplier capabilities, cost considerations, and sustainability goals. As consumer preferences and regulatory environments evolve, glass remains a resilient and adaptable packaging solution worthy of strategic investment and continuous optimization in the B2B supply chain.